Artemis Gold Provides Q3 Update on Blackwater Mine Construction Progress

October 24, 2023

Project Remains Fully Funded, Within Guidance for Initial Capital Expenditure, and on Schedule

Vancouver, British Columbia – Artemis Gold Inc. (TSX-V: ARTG) (“Artemis Gold” or the “Company”) provides an update on Q3 construction progress at the Blackwater Mine in central British Columbia. The project remains fully funded, within the guidance for initial capital expenditure, and on schedule for first gold pour in H2 2024.

At September 30, 2023, overall construction was 45% complete, and approximately C$280 million of the guided initial capital expenditure of C$730 to C$750 million had been spent. The lag between the spend and percentage of completion is as planned and consistent with a typical project S-curve.

Artemis Gold Chairman and CEO Steven Dean commented: “Our workforce and construction activity at Blackwater returned to 100% following the wildfire events in early Q3. We remain focused on a disciplined approach to development and remain on track for the first gold pour in H2 2024.”

Construction Update

Earthworks continued in priority infrastructure areas, with approximately 505 hectares logged and cleared. Over 90% of access roads needed for Phase 1 construction are now operable. Construction of the site water management facilities, including the water management pond and Davidson Creek diversion, is well advanced.

Total major works man-hours worked up to September 30, 2023, were more than 440,000 man-hours with a zero LTIFRi and an AIFRii of 138.97.

Plant Site

Process plant construction progressed well on a number of fronts, including the mill building foundation preparation, reagents building, ball mill pedestals, carbon in leach (CIL) tanks, and the primary, secondary, and tertiary crushers structures, as well as the reclaim tunnel civil works. Hydro testing of the first CIL tank has been completed.

Construction of the run-of-mine (ROM) wall surpassed 75% complete at the end of September 2023 and is scheduled to be completed by the end of October 2023, with the ROM dump slab civil works scheduled to begin shortly thereafter.

Heavy Equipment

The construction fleet has been expanded to include 60- and 100-tonne rigid frame haul trucks and 150-tonne excavators, providing more material movement capability to key areas. Initial deliveries of the owner mining fleet are well advanced, including 400-tonne hydraulic backhoe excavators and three 240-tonne rigid frame haul trucks which have arrived and are in various stages of assembly. Fleet assembly is expected to be sufficiently advanced by year end in preparation for pre-stripping and earthworks support in 2024. The remainder of the fleet to support operations will arrive predominately in the first half of 2024.

Engineering and Procurement

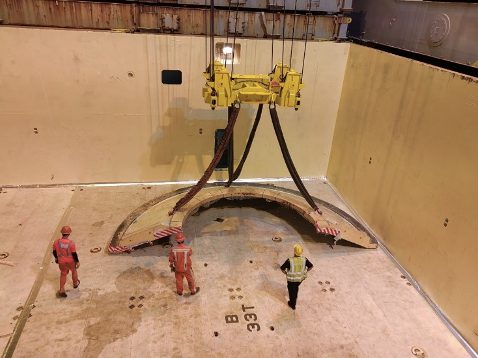

At the end of September 2023, the Sedgman EPC contract works passed 61% complete overall, with engineering and design over 95% complete. Procurement is 96% complete and progressing toward the conclusion of package awards. Key mechanical equipment packages are in various stages of delivery, including the primary, secondary and tertiary crushers and associated dry screens, while the wet plant vibrating screens, ADR plant, gravity concentrator(s) and intensive leach reactor are all on site. The major ball mill components, including the shell and head segments, are in transit and expected to arrive in October. The electrical machinery control centre fabrication is complete and will undergo factory testing in early Q4 2023.

Contracts are being finalized for explosives supply, mine fleet tire supply and the assay laboratory, while proposals for the oxygen plant and water treatment plants are in the final stages of being evaluated. Right-of-way clearing and construction of the 135km 225kV transmission line is scheduled to begin in Q4 2023.

Personnel

The Company’s staffing numbers at the Blackwater Mine surpassed 250 employees in Q3 2023, with approximately 20% female and 30% identifying as Indigenous. Over 50% of the development team is from the local region and over 80% are B.C. residents. The total workforce at the Blackwater Mine, including staff and contractors, was more than 500 at the end of September.

Funding

At September 30, 2023, Artemis Gold had estimated remaining Phase 1 capital expenditures of $450 to $470 million. At the same date, the committed sources of funding totalled C$560 million, comprising:

- cash and cash equivalents of C$73 million;

- remaining drawdowns from streaming agreements of US$45.2 million (approximately C$62 million);

- a project loan facility of C$385 million (including up to C$25 million of capitalized interest), and

- a cost overrun facility of C$40 million.

Hedging

Artemis Gold has continued to execute a modest hedging program to secure the returns on capital invested in the early years of operations and further de-risk servicing of the Company’s project loan facility during the pay-back period. To date, the Company has entered into gold forward sales agreements to deliver 190,000 ounces of gold bullion between March 2025 and December 2027 at a weighted average sales price of C$2,851 per gold ounce, which is more than 40% higher than the gold price assumption in the September 2021 Feasibility Study.

Engineering Study

With Phase 1 fully funded and 45% complete at the end of September 2023, a study to evaluate the benefits of advancing the Phase 2 expansion earlier than contemplated in the September 2021 Feasibility Study is progressing well. The results of this study are expected to be released in early 2024.

Artemis Gold President and COO Jeremy Langford commented: “The return and ramp-up to full construction activities following the B.C wildfire event in Q3 2023 was a testimony to our disciplined and coordinated workforce and collaborative partners. Q3 2023 saw positive gains in efficiencies and productivity, with momentum building throughout the latter stages of the period. To date, the project remains within our guidance for initial capital expenditure and on track for first gold in H2 2024 as planned.”

Video

Watch here for a Q3 project update video:

Photos

About Artemis Gold

Artemis Gold is a well-financed, growth-oriented gold development company with a strong financial capacity aimed at creating shareholder value through the identification, acquisition, and development of gold properties in mining-friendly jurisdictions. The company’s current focus is the construction of the Blackwater Mine project in central British Columbia approximately 160km southwest of Prince George and 450km northeast of Vancouver. The project is one of the largest capital investments in the Bulkley-Nechako, Fraser-Fort George and Cariboo regions of B.C. in the last decade. The first pour of gold and silver from Blackwater Mine is expected in H2 2024 and the mine is expected to be in production for a minimum of 22 years. Artemis Gold trades on the TSX-V under the symbol ARTG. For more information visit www.artemisgoldinc.com.

Qualified Person

Jeremy Langford, FAUSIMM, a Qualified Person as defined by National Instrument 43-101, has reviewed and approved the scientific and technical information in this press release.

On behalf of the Board of Directors

Steven Dean

Chairman and Chief Executive Officer

+1 604 558 1107

Investor Relations contact

Meg Brown

Vice President, Investor Relations

[email protected]

+1 778 899 0518

Media relations contact

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Cautionary Note Regarding Forward-looking Information

This press release contains certain forward-looking statements and forward-looking information as defined under applicable Canadian and U.S. securities laws. Statements contained in this press release that are not historical facts are forward-looking statements that involve known and unknown risks and uncertainties. Any statements that refer to expectations, projections or other characterizations of future events or circumstances contain forward-looking statements. In certain cases, forward-looking statements and information can be identified using forward-looking terminology such as “may”, “will”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “continue”, “plans”, “potential” or similar terminology. Forward-looking statements and information are made as of the date of this press release, and include, but are not limited to, statements regarding the potential of the Blackwater mine project; the jobs to be created in connection with the project; the contribution of the project to the economy; opinions of the Province of British Columbia regarding the project and the region; agreements and relationships with Indigenous partners; the future of mining in British Columbia; the plans of the Company with respect to the project, including construction, site preparation, clearing, consultation with indigenous groups, and other plans and expectations of the Company with respect to the project.

These forward-looking statements represent management’s current beliefs, expectations, estimates and projections regarding future events and operating performance, which are based on information currently available to management, management’s historical experience, perception of trends and current business conditions, expected future developments and other factors which management considers appropriate. Such forward-looking statements involve numerous risks and uncertainties, and actual results may vary. Important risks and other factors that may cause actual results to vary include, without limitation: risks related to the ability of the Company to accomplish its plans and objectives with respect to the development of the project within the expected timing or at all, the timing and receipt of certain required approvals, changes in commodity prices, changes in interest and currency exchange rates, risks inherent in exploration estimates and results, risks inherent in exploration and development activities, changes in development or mining plans due to changes in logistical, technical or other factors, unanticipated operational difficulties (including failure of plant, equipment or processes to operate in accordance with specifications, cost escalation, unavailability of materials, equipment or third party contractors, delays in the receipt of government approvals, industrial disturbances, job action, and unanticipated events related to heath, safety and environmental matters), changes in governmental regulation of mining operations, political risk, social unrest, changes in general economic conditions or conditions in the financial markets, and other risks related to the ability of the Company to proceed with its plans for the project and other risks set out in the Company’s most recent MD&A, which is available on the Company’s website at www.artemisgoldinc.com and on SEDAR at www.sedar.com.

In making the forward-looking statements in this press release, the Company has applied several material assumptions, including without limitation, the assumptions that: (1) market fundamentals will result in sustained mineral demand and prices; (2) any necessary approvals and consents in connection with the development of the project will be obtained; (3) financing for the development, construction and continued operation of the project will continue to be available on terms suitable to the Company; (4) sustained commodity prices will continue to make the project economically viable; and (5) there will not be any unfavourable changes to the economic, political, permitting and legal climate in which the Company operates. Although the Company has attempted to identify important factors that could affect the Company and may cause actual actions, events, or results to differ materially from those described in forward-looking statements, there may be other factors that cause the actual results or performance by the Company to differ materially from those expressed in or implied by any forward-looking statements. Accordingly, no assurances can be given that any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do so, what impact they will have on the results of operations or the financial condition of the Company. Investors should therefore not place undue reliance on forward-looking statements. The Company is under no obligation and expressly disclaims any obligation, to update, alter or otherwise revise any forward-looking statement, whether written or oral, that may be made from time to time, whether because of new information, future events or otherwise, except as may be required under applicable securities laws.

1 LTIFR or Lost Time Injury Frequency Rate refers to the number of lost time injuries occurring per million man-hours worked, divided by total man-hours worked.

2 AIFR or All Injury Frequency Rate refers to the total number of recordable incidents occurring per million man-hours worked, divided by total man-hours worked.