Artemis Presents Key Data on Near Surface High Grade Mineralization at Blackwater Commencement of Grade Control Drilling Program

All amounts are in Canadian Dollars unless otherwise noted

ARTEMIS GOLD INC. (TSXV: ARTG) (“Artemis” or the “Company”) is pleased to present key data on the near surface high grade starter pit mineralization and the commencement of its grade control drilling program at the company’s Blackwater Gold project in Central British Columbia, Canada (“Blackwater” or the “Project”).

The Company has budgeted for a 35,000 metre reverse circulation drill program (the “Program”) targeting mineralization planned to be mined during the first year of production within Phase 1 of the Blackwater development plan as set out in the Company’s 2020 Pre-Feasibility Study on the Project (“Blackwater Gold Project British Columbia NI 43-101 Technical Report on Pre-Feasibility Study” with an effective date of August 26, 2020, available on the Company’s website and on SEDAR at www.sedar.com (“2020 PFS”)). The primary objectives of the Program are to:

- Optimize grade selectivity and mine schedule for managing the tonnes and grade of mineralized material to be processed in the first year of operations;

- Increase data density by up to 16 times over current diamond drilling data;

- More accurately delineate ore and waste boundaries to mitigate ore dilution;

- Improve drill and blast designs;

- De-risk uncertainty regarding ore mined and milled during ramp-up from a project financing perspective; and

- Provide a larger sample size to reduce the grade variability of mineralization

Steven Dean, Chairman and CEO commented “The grade control drilling program at Blackwater is similar to the practice successfully applied at Atlantic Gold, providing substantially more data to optimize mine planning. This program is also designed to further demonstrate the strong continuity of high-grade mineralization at the start of the mine life, and will provide a higher confidence level in the Phase 1 mining schedule outlined in the Company’s 2020 PFS, thereby maximizing competitive terms from project financing partners.

As outlined in the attached bench plans, longitudinal and cross sections, the Project exhibits excellent continuity of high-grade mineralization near surface as well as in many other sections of the orebody. Through our staged approach, we will be able to take advantage of the high-grade mineralization in the early years of the mine life, thereby improving payback, IRR and Phase 1 free cash flows, driving best in class economics for this very large scale project.”

Summary of Selected Drilling to Date

Near-Surface Intercepts

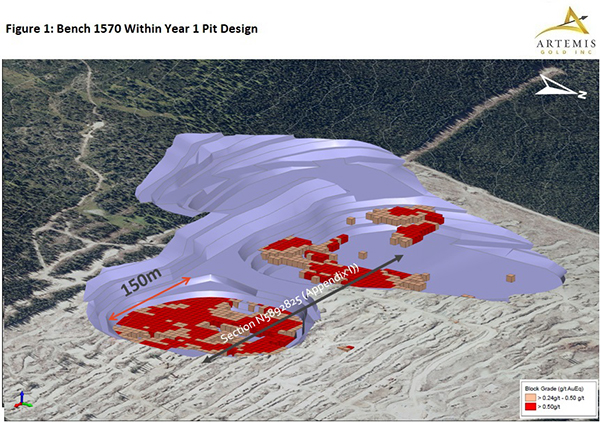

Some of the high-grade mineralized zones intersected in previous drill programs as conducted by the previous owner of Blackwater, New Gold Inc. (“New Gold”), are presented in Table 1. These high-grade mineralized zones are also illustrated in the Stage 1 pit design for bench 1570 (see attached Figure 1). This bench is one of seven benches planned to be mined in the first year of operations based on the Company’s 2020 PFS. The 2020 PFS mine plan, on bench 1570 of the Phase 1 open pit, reports Mineral Reserves of 1,365,000 tonnes at grade of 1.45 g/t AuEq1 at a >0.50 g/t AuEq1 cut-off grade, available for processing, with an additional 795,000 tonnes grading 0.36 g/t AuEq1 to be stockpiled for processing in Phase 4.

Table 1: Near Surface Intercepts in Section N58928252

| Drill Hole | Hole_Type | East | North | RL | Azimuth | Dip | Depth | From | To | Interval | Au | Ag | AuEq1 |

| (m) | (m) | (m) | (g/t) | (g/t) | (g/t) | ||||||||

| BW0213 | DDH | 375228 | 5892824 | 1608.1 | 268 | -60 | 471 | 28 | 49 | 21 | 1.91 | 4.33 | 1.93 |

| BW0283 | DDH | 375726 | 5892824 | 1598.8 | 270 | -60 | 518 | 25.5 | 55 | 29.5 | 1.93 | 10.23 | 1.99 |

| BW0297 | DDH | 375427 | 5892824 | 1613.5 | 175 | -60 | 474 | 7 | 24 | 17 | 2.07 | 9.04 | 2.12 |

| BW0304 | DDH | 375527 | 5892824 | 1607.5 | 270 | -60 | 503 | 23 | 28 | 5 | 2.05 | 7.00 | 2.10 |

| BW0315 | DDH | 375626 | 5892824 | 1604.3 | 270 | -60 | 528 | 43 | 52 | 9 | 3.89 | 9.23 | 3.94 |

| BW0557 | DDH | 375552 | 5892825 | 1609.6 | 270 | -60 | 254 | 37 | 68 | 31 | 1.01 | 6.63 | 1.05 |

| BW0587 | DDH | 375651 | 5892825 | 1603.1 | 270 | -60 | 252 | 38 | 61 | 23 | 6.11 | 22.07 | 6.24 |

| Incl. 1m | 53 | 54 | 1 | 65.80 | 230.00 | 67.18 | |||||||

| and 1m | 56 | 57 | 1 | 26.10 | 53.90 | 26.42 | |||||||

| BW0598 | DDH | 375676 | 5892825 | 1600.9 | 270 | -60 | 244 | 11 | 16 | 5 | 1.16 | 7.52 | 1.21 |

| BW0609 | DDH | 375701 | 5892825 | 1599.2 | 270 | -60 | 241 | 37 | 49 | 12 | 2.00 | 16.64 | 2.10 |

| BW0624 | DDH | 375251 | 5892825 | 1608.7 | 270 | -60 | 251 | 31 | 39 | 8 | 1.74 | 2.29 | 1.75 |

| BW0657 | DDH | 375176 | 5892824 | 1604.9 | 270 | -60 | 249 | 46 | 51 | 5.25 | 1.08 | 7.77 | 1.12 |

| BW1012 | DDH | 375251 | 5892923 | 1604.8 | 180 | -60 | 200 | 12 | 20 | 8 | 1.50 | 11.86 | 1.57 |

| 25 | 33 | 8 | 1.63 | 9.24 | 1.68 | ||||||||

| 36 | 84 | 48 | 2.76 | 7.85 | 2.81 | ||||||||

| BW1013 | DDH | 375201 | 5892897 | 1603.1 | 180 | -60 | 200 | 7.5 | 200 | 192.5 | 2.76 | 8.45 | 2.81 |

Source: Artemis Gold Inc.

Note: Drill hole intercepts reflect between 70 and 90% of the true widths of the orebody.

Intercepts Commencing at 50-100m Downhole

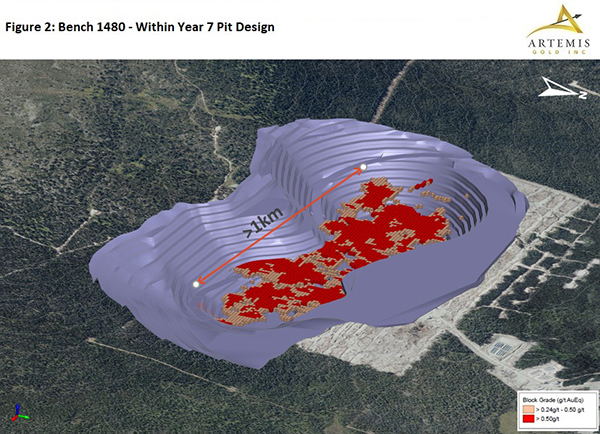

Certain high-grade mineralized zones commencing at 50-100m downhole intersected during New Gold’s previous drill programs are also presented in Table 2. These high-grade mineralized zones are also illustrated in the open pit design for bench 1480 (see attached Figure 2), one of eight benches planned to be mined in year seven of operations per the 2020 PFS. Within this bench, the Mineral Reserve reports up to 4,554,000 tonnes at a grade of 1.39 g/t AuEq1 of mineralized material at a >0.50 g/t AuEq1 cut-off grade available for processing with an additional 2,406,000 tonnes grading 0.36 g/t AuEq1 to be stockpiled for processing in Phase 4.

Table 2: Intercepts in Section N5892825 (commencing between 50-100m down drill hole)2

| Drill Hole | Hole_T | East | North | RL | Azimuth | Dip | Depth | From | To | Interval | Au | Ag | AuEq1 |

| (m) | (m) | (m) | (g/t) | (g/t) | (g/t) | ||||||||

| BW0283 | DDH | 375726 | 5892824 | 1598.8 | 270 | -60 | 518 | 58 | 67 | 9 | 1.44 | 26.34 | 1.60 |

| BW0304 | DDH | 375527 | 5892824 | 1607.5 | 270 | -60 | 503 | 99 | 107 | 8 | 1.30 | 10.20 | 1.36 |

| BW0315 | DDH | 375626 | 5892824 | 1604.3 | 270 | -60 | 528 | 59 | 65 | 6 | 1.22 | 4.58 | 1.24 |

| BW0548 | DDH | 375501 | 5892825 | 1610.3 | 270 | -60 | 257 | 85 | 96 | 11 | 5.73 | 22.37 | 5.86 |

| Incl. 1m | 94 | 95 | 1 | 25.60 | 8.60 | 25.65 | |||||||

| BW0557 | DDH | 375552 | 5892825 | 1609.6 | 270 | -60 | 254 | 74 | 125 | 51 | 3.94 | 20.62 | 4.06 |

| Incl. 1m | 84 | 85 | 1 | 28.20 | 47.60 | 28.49 | |||||||

| BW0566 | DDH | 375577 | 5892825 | 1607.9 | 270 | -60 | 251 | 69 | 100 | 31 | 2.03 | 7.72 | 2.08 |

| BW0587 | DDH | 375651 | 5892825 | 1603.1 | 270 | -60 | 252 | 89 | 122 | 33 | 1.11 | 7.14 | 1.15 |

| BW0591 | DDH | 375351 | 5892824 | 1612.1 | 270 | -60 | 258 | 83 | 88 | 5 | 9.13 | 4.38 | 9.16 |

| Incl. 1m | 86 | 87 | 1 | 40.50 | 10.10 | 40.56 | |||||||

| BW0601 | DDH | 375301 | 5892825 | 1610.3 | 270 | -60 | 255 | 73 | 176 | 103 | 2.74 | 6.47 | 2.78 |

| BW0609 | DDH | 375701 | 5892825 | 1599.2 | 270 | -60 | 241 | 52 | 72 | 20 | 3.15 | 19.11 | 3.26 |

| 76 | 89 | 13 | 5.62 | 46.96 | 5.90 | ||||||||

| BW0613 | DDH | 375276 | 5892824 | 1609.8 | 270 | -60 | 254 | 61 | 174 | 113 | 4.68 | 9.01 | 4.73 |

| Incl. 1m | 129 | 130 | 1 | 51.00 | 16.90 | 51.10 | |||||||

| BW0623 | DDH | 375751 | 5892825 | 1596.1 | 270 | -60 | 238 | 61 | 116 | 55 | 4.36 | 14.54 | 4.44 |

| Incl. 1m | 76 | 77 | 1 | 39.80 | 32.70 | 39.99 | |||||||

| BW0624 | DDH | 375251 | 5892825 | 1608.7 | 270 | -60 | 251 | 53 | 104 | 51 | 5.52 | 13.96 | 5.60 |

| Incl. 1m | 81 | 82 | 1 | 33.10 | 37.20 | 33.32 | |||||||

| and 1m | 83 | 84 | 1 | 25.50 | 85.60 | 26.01 | |||||||

| BW0641 | DDH | 375202 | 5892824 | 1606.5 | 270 | -60 | 250 | 78 | 95 | 17 | 1.46 | 12.96 | 1.54 |

| BW0655 | DDH | 375801 | 5892825 | 1591.7 | 270 | -60 | 232 | 65 | 79 | 14 | 1.35 | 14.14 | 1.43 |

| 85 | 94 | 9 | 2.90 | 23.19 | 3.04 | ||||||||

| BW1012 | DDH | 375251 | 5892923 | 1604.8 | 180 | -60 | 200 | 91 | 188 | 97 | 2.07 | 6.00 | 2.11 |

Source: Artemis Gold Inc.

Note: Drill hole intercepts reflect between 70 and 90% of the true widths of the orebody.

As illustrated in the tables above, the higher grade near-surface mineralization supports an average grade of 1.57 g/t Au processed in Phase 1 and an average grade of 1.50 g/t Au processed for the first seven years of operation (all of Phase 1 and the first two years of Phase 2 per the 2020 PFS).

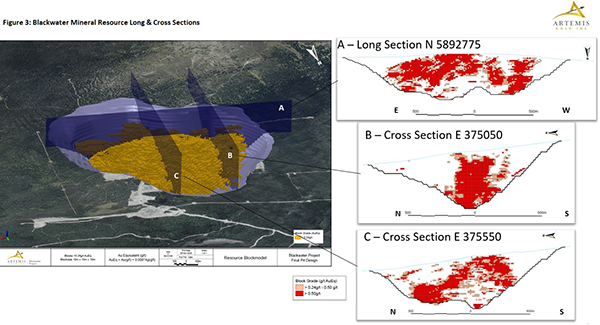

Figure 3 (attached) contains a longitudinal section and two cross-sections, which further illustrates the continuity of high-grade mineralization throughout the estimated Blackwater Mineral Resource per the 2020 PFS.

Details of the Program

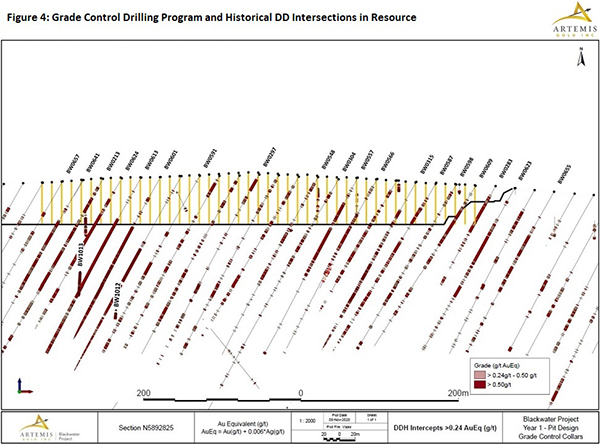

The first 35,000 metre grade control program is focused on delineating an area in the southwestern portion of the Blackwater pit (scheduled in the 2020 PFS to be mined in year 1 of operations), which returned significant near surface high-grade mineralized intercepts noted above (see Figure 4, attached).

The Program will provide up to 16 times higher data density than used for the Mineral Resource estimate from the 2020 PFS to allow optimization of grade selectivity and mine schedule for managing ore to be processed. This practice significantly de-risks mine performance, particularly in the initial years of production.

A grade control drilling program will be part of normal mining operations once in production, with drilling typically staying ahead of ore mining by 6-12 months.

The Program is expected to commence in November and continue to Q2 2021.

Exploration Upside

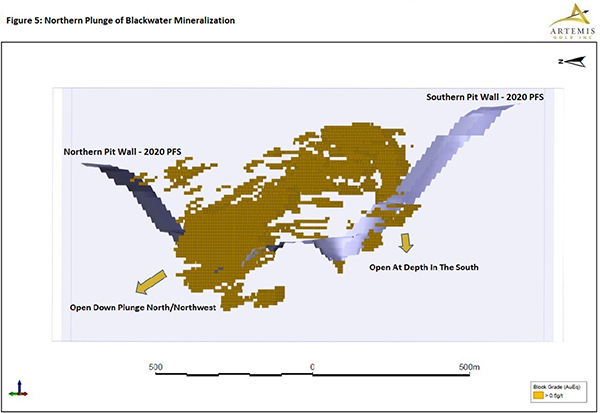

Blackwater has a high level of drilling density with more than 300,000 metres of diamond drilling previously completed on the Project, ultimately supporting its current 2020 PFS Mineral Resource estimate (with 75% of the Measured and Indicated Mineral Resource in the Measured category). However, despite the extent of the drilling to date, the deposit remains open to potentially substantial expansion. As illustrated in Figure 5 (attached), the deposit remains open to the north, north-west and at depth in the southwest.

Management plans to complete a limited diamond drill program in 2021 to test for extensions to the known mineralization of the deposit in the directions that remain open.

Gold Price Sensitivity

On August 26, 2020, the Company issued a news release disclosing the results of the 2020 PFS. The base case scenario from the 2020 PFS was based on a US$1,541 gold price and a 0.76 US/CAD exchange rate resulting in an after-tax NPV (5%) of $2.2 billion (highlighted in green and bolded in the table below). The following table is presented to illustrate the sensitivity on the after-tax NPV (5%) for the project to changes in the price of gold and US/CAD exchanges rates.

Table 3: Blackwater CAD$ After-Tax NPV (5%) sensitivity based on changes to US dollar gold price & US/CAD exchange rate – 2020 PFS ($000’s)

| US/CAD | US $ Gold Price | ||||

| $ 1,050 | $ 1,300 | $ 1,541 | $ 1,800 | $ 2,050 | |

| 0.60 | 1,672,105 | 2,654,199 | 3,600,002 | 4,616,021 | 5,596,249 |

| 0.65 | 1,324,653 | 2,232,499 | 3,105,715 | 4,043,857 | 4,949,033 |

| 0.70 | 1,026,286 | 1,870,434 | 2,681,774 | 3,553,299 | 4,394,022 |

| 0.76 | 721,073 | 1,498,745 | 2,246,820 | 3,049,606 | 3,824,263 |

| 0.80 | 540,655 | 1,281,108 | 1,992,942 | 2,755,653 | 3,491,850 |

| 0.85 | 329,112 | 1,037,579 | 1,708,917 | 2,427,104 | 3,120,118 |

| 0.90 | 141,887 | 825,454 | 1,456,039 | 2,135,194 | 2,789,605 |

| 0.95 | (33,651) | 631,179 | 1,229,101 | 1,873,937 | 2,493,860 |

Source: Blackwater Gold Project British Columbia NI 43-101 Technical Report on Pre-Feasibility Study, reported on August 26, 2020

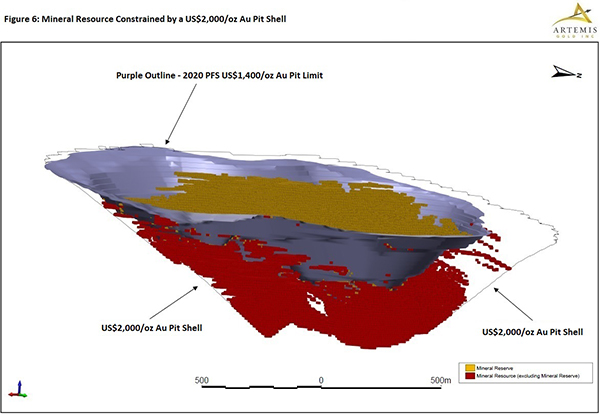

What is not reflected in the above sensitivity table is the potential to expand the current pit shell to capture additional Measured & Indicated Mineral Resources at a higher gold price. Figure 6 (attached) shows the additional Measured & Indicated Mineral Resources captured within a US$2,000/oz. pit shell. If the price of gold remains elevated and potentially moves higher, there is substantial potential to increase the Mineral Reserve estimate at Blackwater without any further exploration.

Conference Call

With the commencement of the Program, the Artemis executive team will be hosting a conference call on November 16, 2020 at 12:00pm EST (9:00am PST) to review the key data on the near surface high-grade mineralization within the Blackwater starter pit, the objectives of the Program and the exploration upside potential for the Project.

Participants may join the call by dialing:

Participant Dial-in Numbers:

| International Toll: | +1 (604) 638-5340 |

| Toll Free – Canada/USA: | +1 (800) 319-4610 |

Please provide the company name (Artemis Gold Inc.) to the operator. A recorded playback of the call will be available shortly after the call’s completion for 30 days by dialing:

| International Toll: | +1 (604) 638-9010 |

| Toll Free – Canada/USA: | +1 (800) 319-6413 |

Enter the replay passcode: 5629, an MP3 recording will also be available on the Artemis website.

Technical Disclosure

- All Gold assays reported are based on a 50g Fire Assay atomic absorption spectrometry of 1kg pulverized sub-sample splits of crushed, sawn half HQ core. Samples were analyzed for silver by four acid digestion ICP AES finish until July 2012, after which time silver was analyzed by a four-acid digestion AAS. Intercepts are calculated using a 0.5g/t AuEq cut off grade with a maximum of 2m of consecutive waste. Only intercepts greater than 5m of length and weighted average grades above 1g/t AuEq are reported.

- Duplicates, Blanks and Certified standards prepared by third-party laboratories were routinely inserted by New Gold. Sample preparation and assaying of reported assay results was undertaken at the Vancouver laboratory of ALS Canada Ltd, an entity having no other relationship with the Company. ALS employ a standard routine of duplicate and check assays and reference standards. Standards, blind blanks, and duplicate assay results are within an acceptable range of tolerance. Core recovery is estimated for each meter and averages 92%, median being at 96%. Drillhole intercept included in this press release are reflecting between 70 and 90% of the true widths of the orebody.

- Drill hole intercepts included in this press release are reflecting between 70 and 90% of the true widths of the orebody.

- The AuEq values were calculated using US $1,400/oz. Au, US $15/oz. Ag, a gold metallurgical recovery of 93%, silver metallurgical recovery of 55%, and mining smelter terms for the following equation: AuEq = Au g/t + (Ag g/t x 0.006).

- Mineral Reserves as reported in the 2020 PFS.

- In the opinion of the Qualified Persons (defined below), sufficient verification checks have been undertaken on the database that the data is virtually error free and appropriate to support the technical figures in this press release.

Qualified Persons

Marc Schulte, P.Eng., of Moose Mountain Technical Services, independent of the Company and a Qualified Person (“QP”) as defined by National Instrument 43-101 ("NI 43-101") has reviewed and approved the mineral reserves related disclosure in this news release. All other scientific and technical information in this news release has been reviewed and approved by Klaus Popelka, P. Geo., Manager Resource Geology for the Company, and a QP as defined by NI 43-101.

ARTEMIS GOLD INC.

On behalf of the Board of Directors

“Steven Dean”

Chairman and Chief Executive Officer

+1 604 558 1107

For further information:

Nick Campbell, VP Capital Markets, +1 (604) 558-1107.

Chris Batalha, CFO and Corporate Secretary, +1 (604) 558-1107.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Information

This news release contains certain “forward looking statements” and certain “forward-looking information” as defined under applicable Canadian and U.S. securities laws. Forward-looking statements and information can generally be identified by the use of forward-looking terminology such as “may”, “will”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “continue”, “plans”, “potential” or similar terminology. Forward-looking statements and information are not historical facts, are made as of the date of this news release, and include, but are not limited to, statements regarding the Program; the planned next steps of the Company with respect to the Project, including permitting, drilling programs, awarding EPC Contracts, arranging debt and equity financing, consultation with indigenous groups and work on the Definitive Feasibility Study; and other plans and expectations of the Company with respect to the Project. These forward-looking statements involve numerous risks and uncertainties and actual results may vary. Important factors that may cause actual results to vary include without limitation, risks related to the ability of the Company to accomplish its plans and objectives with respect to the development of the Project within the expected timing or at all, the timing and receipt of certain required approvals, changes in commodity prices, changes in interest and currency exchange rates, risks inherent in exploration and development activities, changes in development or mining plans due to changes in logistical, technical or other factors, unanticipated operational difficulties (including failure of plant, equipment or processes to operate in accordance with specifications, cost escalation, unavailability of materials, equipment or third party contractors, delays in the receipt of government approvals, industrial disturbances, job action, and unanticipated events related to heath, safety and environmental matters), the COVID-19 pandemic, political risk, social unrest, changes in general economic conditions or conditions in the financial markets, and other risks related to the ability of the Company to proceed with its plans for the Project and other risks set out in the Company’s most recent MD&A. In making the forward-looking statements in this news release, the Company has applied several material assumptions, including without limitation, the assumptions that: (1) market fundamentals will result in sustained mineral demand and prices; (2) the receipt of any necessary approvals and consents in connection with the development of the Project; (3) the availability of financing on suitable terms for the development, construction and continued operation of the Project; (4) sustained commodity prices such that the Project remains economically viable; and (5) that the COVID-19 pandemic and restrictions related thereto will not materially impact the Company or prevent the Company from operating its business as planned. The actual results or performance by the Company could differ materially from those expressed in, or implied by, any forward-looking statements. Accordingly, no assurances can be given that any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do so, what impact they will have on the results of operations or financial condition of the Company. Except as required by law, the Company is under no obligation, and expressly disclaim any obligation, to update, alter or otherwise revise any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

1 Refer to notes 4 and 5 within the section entitled “Technical Disclosure” at the end of this press release

2 Refer to notes 1, 2, and 3 within the section entitled ”Technical Disclosure” at the end of this press release